Mortgage After Bankruptcy

Getting A Mortgage After Bankruptcy Is Possible

Peoples Bank recognizes that buying a home or refinancing an existing mortgage is a goal for many clients after they have filed a Chapter 13 Bankruptcy plan. Unlike other banks, we have a department dedicated to helping borrowers get a mortgage after bankruptcy. Our Chapter 13 Bankruptcy Division offers mortgages as soon as 1 day after a completed Chapter 13 Bankruptcy plan. We also offer mortgage loans during your Chapter 13 bankruptcy plan. Our clients have reviewed us as one of the top bankruptcy mortgage companies in the Nation because we provide valuable guidance when it comes to buying or refinancing a house after bankruptcy.

Speak with one of our company’s Mortgage Consultants about getting a mortgage after bankruptcy. Select either Purchase or Refinance from the section below to set up your FREE consultation, or by calling us at (843) 606-6058 or toll-free at (855) 406-0197.

Table of Contents

What is the Process for Refinancing or Buying a House After Bankruptcy?

Our team has developed extensive expertise helping thousands of clients after their bankruptcy. Below is our proven step-by-step process for refinancing or buying a house after a bankruptcy.

1) Consultation

At Peoples Bank Mortgage, we understand that buying a home after bankruptcy can be intimidating, which is why our Mortgage Consultants take the time to get to know you and your goals. During your consultation, we’ll discuss the most common stumbling blocks that our Bankruptcy borrowers face when buying a house after bankruptcy, and provide you with a clear understanding of the options available to you. Whether you’re a first-time homebuyer or a seasoned homeowner, our team is dedicated to making the process as smooth and stress-free as possible.

2) Credit Review

One of the biggest challenges faced by borrowers with a bankruptcy on their record is their credit score. That’s why our Mortgage Consultants run a free 3-in-1 credit report and carefully review it to identify any inaccuracies or issues that need to be addressed. We then consult with you on a range of topics, from verification of accounts to updating credit inaccuracies that are common with our Bankruptcy clients. If your credit score needs improvement, we provide a clear path to improving it, so you can qualify for the home loan product that’s right for you.

3) Application

Once we’ve identified the appropriate home loan product for your needs, our team will guide you through the application process, whether online, on the phone, or in person. We understand that the application can be overwhelming, so we’re always available to answer any questions you might have and provide guidance to ensure that you’re submitting a complete and accurate application.

4) Loan Submission

After you’ve completed the application, our processing specialists will gather all the necessary information required to submit the home loan request to underwriting. We know that every borrower’s situation is unique, which is why we work closely with you and our underwriters to ensure that your application receives the attention it deserves. If there are any issues or conditions that need to be addressed, our experienced mortgage consultants will help resolve them, so you can move forward with your home purchase.

5) Removing Conditions

In some instances, our mortgage consultants will receive a list of conditions from the underwriter that request further clarification specifically to address problems associated with our Bankruptcy clients. We understand that these conditions can be complex and difficult to navigate, which is why we are adept at solving problems that you might not be able to get past with other lenders, like liens on titles or other complex income issues. Our goal is to help you get the home loan product that’s right for you, even if you’ve faced bankruptcy in the past.

6) Clear to Close

When your loan has been approved, we’ll collect the final documentation needed to close your mortgage loan. Your closing attorney or the appropriate escrow agent will arrange the final insurance and escrows. Our team will work with you to ensure that everything is in order and that you’re ready to close on your new home.

7) Closing

Congratulations! You’ve successfully completed the home buying process and are ready to close on your new home. During the closing, we’ll review, witness, sign, and notarize the final documents. Our goal is to make this process as stress-free and straightforward as possible, so you can focus on settling into your new home.

8) Staying in Touch

At Peoples Bank Mortgage, we understand that buying a home is just the beginning of your financial journey. That’s why we keep in touch with you through a yearly mortgage review and personalized updates about mortgage trends. Our team is dedicated to helping you achieve your financial goals and ensuring that you have the support you need to make informed decisions about your mortgage.

For more information, view The Guide to Getting a Home Loan After Bankruptcy Discharge.

Advantages to Getting a Mortgage After Bankruptcy May Include:

- Lower Payments

- Cash-out refinance options

- Lower mortgage interest rates

- Shorter home loan terms

- Low down payment options for qualified home purchases

- The ability to skip 1-2 months of payments for refinancing

- Pay off your Bankruptcy Plan sooner

How Can Peoples Bank Offer a Mortgages so soon after Bankruptcy?

Being one of the only companies in the Country (that we know of) with a department that deals with mortgage loans after bankruptcy, our team is able to help borrowers achieve their goals of buying a house after bankruptcy faster. We are able to tailor our home loan products to address those specific needs that clients have during or after their bankruptcy. Other banks and mortgage companies do not have the experience or the expertise that we have in dealing with getting a mortgage after bankruptcy.

We are adept at identifying, and correcting credit reporting errors that are common to borrowers with a bankruptcy. For our refinance customers, we can work with title experts to clear up any issues with old liens that were not properly stripped off after discharge. This is in sharp contrast to other banks that force you to wait up to two years to obtain a Chapter 13 home loan. Other banks simply do not understand the common problems our clients face. Peoples Bank Mortgage has experienced professionals, that can help clients obtain a mortgage during their Chapter 13 bankruptcy plan or as soon as 1 day after their bankruptcy discharge.

Questions About Getting a Mortgage After Bankruptcy

How long after bankruptcy can I buy a house?

Our Chapter 13 Bankruptcy Division offers mortgages as soon as 12 months into your Chapter 13 Plan with trustee approval. We also offer home loans 1 day after a completed Chapter 13 Bankruptcy plan without having to receive trustee approval.

How is Peoples Bank Mortgage able to help when I have been turned down by other lenders?

Different banks have different regulations for their lending criteria. Peoples Bank Mortgage, has developed a division specifically for clients who have filed for bankruptcy. We have created products and options customized to fit the needs of our clients who are seeking to buy a home after bankruptcy. Our team is willing and able to put in the time, and effort that most institutions are not willing to devote. We are proud to be the leading company for mortgages after bankruptcy. We pride ourselves in being a trusted resource for people who are in the position of purchasing a home after bankruptcy.

What kind of interest rate should I expect after a Bankruptcy plan?

Many clients who are currently completing, or are coming out of a bankruptcy plan have been stuck with high rates for years during their bankruptcy plan. Home loan interest rates are determined by the market, and a borrower’s unique qualifying criteria. Our clients are often pleasantly surprised when they see the mortgage rate for which they qualify. Our bankruptcy home loan division takes pride in offering highly competitive home loan rates to all of our clientele, which includes those interested in obtaining a mortgage after bankruptcy.

What happens if I don’t quite qualify for your Bankruptcy Division program?

Mortgage after bankruptcy is an obtainable goal, and we are dedicated to helping our client’s purchase or refinance a home after bankruptcy. If we can’t help a client immediately, we provide a path to success by working tirelessly with our borrowers to address the areas that are holding them back. Peoples Bank is here to help you reach your home ownership and mortgage goals.

Are there extra fees that come with the Chapter 13 home loans?

Completing a Chapter 13 Bankruptcy plan is an impressive feat that demonstrates a borrower’s commitment to fiscal discipline and personal responsibility. There are no extra fees associated with getting a mortgage after bankruptcy. Lastly, we treat all our clients fairly and with respect.

What type of home loans are available after bankruptcy?

We also offer a wide variety of home loan programs specifically tailored to borrowers who are buying a house after bankruptcy. For that reason, we work with all kinds of financial situations: conventional mortgages, VA home loans, FHA loans, USDA loans, portfolio loans, jumbo loans, and more! After an in depth analysis, we will present the best available home loan programs, with the best terms, at lowest possible bottom line to you.

What is the difference between a Chapter 7 bankruptcy and a Chapter 13 bankruptcy?

Chapter 7 bankruptcy is a liquidation bankruptcy where you sell your assets to pay off your debts, while Chapter 13 bankruptcy is a reorganization bankruptcy where you pay off your debts over a 3-5 year period through a repayment plan.

Can I still get a mortgage loan if I have a foreclosure on my credit report?

Yes, you can still get a mortgage loan if you have a foreclosure on your credit report, but waiting periods vary by loan product. FHA requires a 3-year wait, VA requires a 2- year wait, and conventional loans require a 7-year wait (or less if the property was surrendered in the bankruptcy plan).

How can I improve my credit score after bankruptcy?

You can improve your credit score after bankruptcy by paying all your bills on time, keeping your credit utilization low, disputing any errors on your credit report, establishing a new positive credit accounts through a secured credit card, and applying for credit sparingly.

What documents will I need to provide for my mortgage loan application?

You will need to provide your tax returns, W-2s, pay stubs, bank statements, and other financial documents as part of your mortgage loan application. These are the most basic items needed. For a full list visit the preapproval checklist page.

What is a pre-qualification letter?

A pre-qualification letter is a document from a lender that indicates how much you can borrow for a mortgage loan based on your income, credit score, and other financial factors. It is an important tool when house hunting as it shows sellers that you are serious about buying a home.

What is the difference between a fixed-rate mortgage and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same for the life of the loan, while an adjustable-rate mortgage has an interest rate that changes periodically, usually every year or every few years.

What is private mortgage insurance (PMI)?

Private mortgage insurance (PMI) is an insurance policy that protects the lender in case you default on your mortgage loan. PMI is usually required if you make a down payment of less than 20% on your home.

Review all FAQs

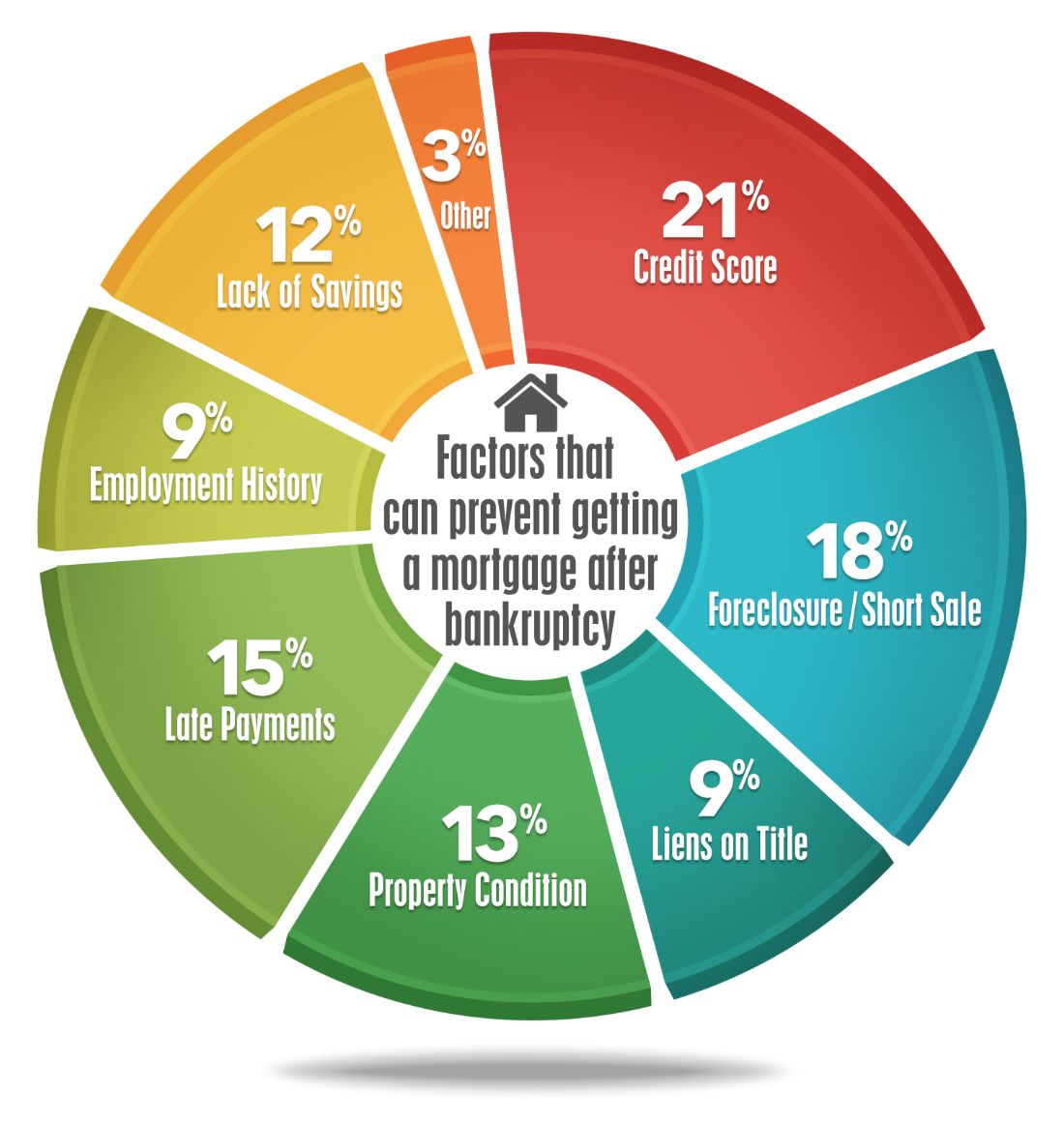

Factors That Can Prevent You From Getting a Mortgage After Bankruptcy

Credit Score (21%)

Credit score is one of the largest factors that relate to getting a mortgage after bankruptcy. Unfortunately, after a bankruptcy, credit scores can drop dramatically. However, even after a bankruptcy, you can begin to raise your credit score by ensuring that all payments on credit accounts are made on time. Also, consider obtaining a secured credit card to rebuild your credit history. It’s essential to monitor your credit report regularly and address any errors quickly. Disputing any inaccurate information can help you remove negative items that should not be on your credit report.

It’s important to remember that each lender has their own credit score requirements, and what may be acceptable to one lender may not be acceptable to another. Peoples Bank offers a wide range of loan programs with varying credit score requirements. We can help you determine what loan program you qualify for based on your credit score and financial situation. Our Mortgage Consultants are experts in working with borrowers who have gone through bankruptcy and can help you navigate the path to homeownership.

Foreclosure/Short Sale (18%)

Foreclosure and short sales can greatly affect your ability to get a mortgage after bankruptcy. Typically, lenders require a waiting period of 3-7 years after a foreclosure or short sale before they will consider lending to you. However, Peoples Bank has access to some portfolio loans that offer more flexible waiting periods for borrowers with recent foreclosures or short sales. Our Mortgage Consultants can help you understand these loan programs and determine if you qualify.

It’s also essential to remember that even if you had a foreclosure or short sale in the past, you can begin to rebuild your credit and improve your financial situation. Taking steps to improve your credit score, save for a down payment, and maintain steady employment can help you overcome these obstacles and achieve your goal of homeownership. At Peoples Bank, we are committed to helping borrowers who have gone through bankruptcy or other financial hardships achieve their dreams of homeownership.

Late Payments (15%)

If you have a history of late payments, it is important to address this issue when applying for a mortgage after bankruptcy. Lenders typically scrutinize your payment history to assess your ability to meet future financial obligations. While late payments can be a red flag, they may not automatically disqualify you from obtaining a mortgage. It is crucial to provide a detailed explanation for any late payments and demonstrate that they were isolated incidents resulting from extenuating circumstances.

Current Home Condition (13%)

The condition of your current home may also impact your mortgage application after bankruptcy. Lenders may evaluate the overall state of your property to ensure it meets certain standards. While a pristine home is not a prerequisite, maintaining a reasonable level of upkeep can positively influence lenders’ perception of your financial responsibility. Be prepared for the possibility that the lender might conduct a property appraisal to assess its value and condition. Making necessary repairs and ensuring the property is presentable can enhance your chances of securing a mortgage post-bankruptcy.

Lack of Money in Savings (12%)

Having enough cash in your savings account is crucial when applying for a mortgage loan after bankruptcy. Not having enough money saved up can greatly impact your ability to qualify for a mortgage loan or reduce your chances of being approved. Typically, lenders will require you to put down a down payment of at least 3-5% of the home’s purchase price. Additionally, having a cash reserve fund is essential to show the lender that you can continue making mortgage payments if something unexpected happens. This reserve fund should ideally cover at least three to six months of mortgage payments.

If you don’t have enough money saved up for a down payment, consider waiting until you have enough money to do so. It’s important to remember that rushing into buying a home without having the necessary funds can lead to financial stress and potentially defaulting on your mortgage payments. Peoples Bank offers a range of mortgage loans with various down payment requirements, including some loans with as little as 0% down payment. Our Mortgage Consultants will work with you to determine the best loan product for your specific needs.

Previous Employment History (9%)

Your employment history plays a significant role in your ability to get a mortgage loan after bankruptcy. Lenders want to see that you have a stable income and a consistent job history, which indicates that you are able to make your mortgage payments on time. Generally, lenders require you to have a minimum of two years of continuous employment before applying for a mortgage loan. However, if you have been at your current job for less than two years, don’t worry, as long as you have a consistent employment history prior to your current job.

In addition to your job history, lenders will also look at your income and current debts. To qualify for a mortgage loan, your debt-to-income ratio should be no more than 43% (some compensating factors may allow you to qualify with a higher DTI). This means that your monthly debt payments, including your mortgage payment, should not exceed 43% of your monthly income. If your debt-to-income ratio is too high, you may need to work on reducing your debt before applying for a mortgage loan. Our Mortgage Consultants can help you evaluate your debt-to-income ratio and offer advice on how to improve it.

Liens On Title (9%)

This includes errors that have not been removed from your history, even after completing your bankruptcy plan. Ensure all liens are removed from your history before buying a home after bankruptcy. This can greatly affect your ability to get a mortgage loan after bankruptcy, as well as affect your interest rate.

Liens on title can be a major obstacle when trying to get a mortgage after bankruptcy. These can occur when a creditor places a legal claim on a property due to unpaid debts, taxes, or other obligations. Even if you have completed your bankruptcy plan, it is crucial to ensure that any liens on your property have been removed. Failure to do so can result in a lower credit score and a higher interest rate on your mortgage loan. Removing liens can be a complex process that often requires the assistance of a qualified attorney. It is important to address any liens on your property as soon as possible, in order to maximize your chances of securing a mortgage after bankruptcy.

Other (3%)

The “Other” category refers to a variety of smaller issues that can. These can include things like missing documentation, unusual income sources, errors on your credit report, or errors in your bankruptcy filings. While these issues may seem minor, they can still have a significant impact on your ability to get a mortgage after bankruptcy. Consulting with an experienced bankruptcy attorney and mortgage consultant can help you identify and address certain issues, as well as provide guidance on how to navigate the mortgage application process successfully. With the right support and preparation, you can overcome these obstacles and achieve your goal of owning a home after bankruptcy.

Buying a House After Bankruptcy: Types of Home Loans Available

Our team has many different home loan options for borrowers to get a mortgage after their bankruptcy. Below is an outline that includes some of the home loan products that we have to offer.

VA Home Loans

VA Home Loans are a great option for U.S. military veterans and their families. These loans are backed by the U.S. Department of Veterans Affairs and are guaranteed by the federal government. This means that veterans can get home loans with low interest rates and minimal down payments, even after bankruptcy. In addition, VA Home Loans have flexible credit requirements, making it easier for veterans to qualify for these loans.

To be eligible for a VA Home Loan, a borrower must have served in the U.S. military for a certain period of time, depending on when they served. Spouses of military members who died in the line of duty may also be eligible for VA Home Loans. With the help of these loans, veterans can purchase a new home or refinance their existing mortgage, providing them with greater financial security and stability.

FHA Home Loans

FHA Home Loans are a type of mortgage that is backed by the Federal Housing Authority (FHA). These loans provide an affordable option for those with lower credit scores and incomes, who are looking to buy a home after bankruptcy. FHA Home Loans require a lower down payment compared to other types of mortgages, making it easier for borrowers to secure financing for their home purchase.

Furthermore, FHA Home Loans have a more lenient credit score requirement than other home loan products, which makes it easier for people with a history of bankruptcy to qualify for a mortgage. With FHA Home Loans, borrowers may also be able to access other benefits, such as lower interest rates and higher loan limits. This can be particularly helpful for those looking to buy a home in a more expensive area.

USDA Home Loans

USDA home loans can be an excellent option for borrowers looking to buy a home in a rural area. These loans are designed to help families with lower incomes achieve homeownership. USDA home loans offer several benefits, including low-interest rates, zero down payment requirements, and flexible credit guidelines. However, there are some restrictions that borrowers must be aware of. To qualify for a USDA home loan after bankruptcy, the property must be located in an eligible rural area as defined by the USDA. Additionally, borrowers must meet income requirements based on the area they are buying a home in.

Government Streamline

The government has implemented several programs to help homeowners refinance their homes after bankruptcy. One such program is the FHA Streamline Refinance program, which is available to homeowners with an FHA-insured mortgage. This program requires minimal documentation and offers simplified underwriting, making it easier for homeowners to qualify for a refinancing loan. The VA Interest Rate Reduction Refinance Loan (IRRRL) is another program that enables veterans to refinance their homes at lower interest rates. These programs can be an excellent option for homeowners looking to lower their monthly payments and interest rates after bankruptcy.

Portfolio Loan

A portfolio loan is a type of mortgage that is not sold to a third-party investor. Instead, the loan is held by the lender in their portfolio. Portfolio loans are designed for borrowers who may not meet the strict underwriting requirements of traditional loans. These loans are often offered by small community banks or credit unions and can be a great option for borrowers who are self-employed, have poor credit, or have experienced bankruptcy. Portfolio loans are typically more flexible than other types of loans, and lenders are more willing to work with borrowers who may have had credit issues in the past. However, borrowers should expect to pay a higher interest rate and provide a larger down payment than they would with a traditional loan.

Jumbo Loan

Lastly, there is the Jumbo Loan option, which provides competitive rates for clients. These loans are specifically designed for individuals who want to obtain loans beyond the conforming loan limits. With a Jumbo Loan, you can purchase a home of a higher value, which can be beneficial if you are looking for a more luxurious home or if you are in an area with higher home prices. Jumbo loans do typically have stricter guidelines for those with past bankruptcies.