Mortgage Interest Rates After Bankruptcy

One of the most frequently asked questions we hear from our customers is; “What kind of mortgage interest rates can I expect after bankruptcy?” While there are many factors that go into the mortgage interest rate you qualify for, the good news is that there are several things you can do that may possibly lower your mortgage interest rates after bankruptcy. Our team at Peoples Bank Mortgage wants to share some factors, and tips with you, that can help you possibly get a lower mortgage interest rate after bankruptcy.

Factors That Will Affect Your Mortgage Interest Rates After Bankruptcy

There are two common types of personal bankruptcy, Chapter 7 and Chapter 13. The most common type of bankruptcy is Chapter 7, and it normally results in the cancellation of all your previous debts by liquidating your assets. Chapter 13 bankruptcy is known as reorganization bankruptcy, and in it your previous debt is reorganized into a manageable repayment plan over three to five years. Even though bankruptcy can severely affect your credit, it’s possible to improve your creditworthiness to the point where you can get competitive mortgage interest rates after bankruptcy.

Bankruptcy’s Effect on Your Credit Score and your Home Interest Rate

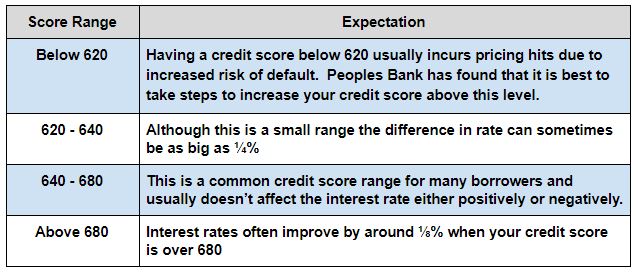

Depending on your financial situation it is not uncommon for bankruptcy filers to see a drop in their credit score between 50 – 150 points. Credit score is one of the most influential factors that affects mortgage interest rates after bankruptcy , as well as your ability to obtain a mortgage after bankruptcy. Don’t let your current credit score affect your decision to buy a house after bankruptcy. Many of our clients are able to rebuild their credit and their credit score during or after their bankruptcy by following our guide (Read more here)

There are three main credit score levels that have the largest effect on your interest rate:

How Your Current Debt Levels Affect Your Mortgage Interest Rate After Bankruptcy

Your current debt level will have a major impact on whether or not you qualify for a loan. However your current debt will only affect what your mortgage interest rates will be if your Debt to Income ratio is too high to qualify for the home loan products with the best interest rates. We suggest making regular on time monthly payments during your Chapter 13 plan, and trying to not incur any additional debt in order to qualify for a new mortgage loan.

Home Loan Programs and Mortgage Interest Rates after Bankruptcy

One factor that can make a large difference in the interest rate you receive, is which home loan program you qualify for. Usually home loan programs that have the best interest rates after bankruptcy are government backed programs like FHA, VA, and USDA home loans. Portfolio loan options can often have higher rates, but work for clients that aren’t able to qualify for government backed home loan programs. The interest rates on Portfolio home loans can be from 0.5% to 3% higher than government backed home loans.

Increase Your Opportunity for Better Interest Rates After Bankruptcy

Understanding that filing for bankruptcy is not the end of your financial well-being is very important. After filing for bankruptcy you now ready to start fresh again, and begin working towards your new financial goals. Peoples Bank has some tips that can help you reach those goals even faster.

Make Your Monthly Payments On-Time

Consistently making on-time monthly payments can possibly lower your mortgage interest rates. Many home loan programs have criteria that require you to show, that you have begun to re-establish your financial position. By proving your efforts to re-gain financial health it shows that you are potentially ready for a home loan again. Ensuring that your monthly payments are on time can help improve your creditworthiness to lenders.

Rebuild Your Credit Score with a Secured Credit Card

A secured credit card is a type payment form where you put down a cash deposit in order to get the card to use on your everyday purchases. Over time your card service company can increase your spending levels based on your cash deposits. While adhering to the limits of your secured card, you should see an improvement in your credit score. Improving your credit score can in turn help secure better mortgage interest rates. Make sure that when you purchase items on your secured card, that you only spend what you know you can pay off. Also, try leaving a small balance on the card at the end of each month. Using this strategy to rebuild your credit, can possibly position you to get lower mortgage interest rates after bankruptcy. Learn more about rebuilding your credit score after bankruptcy .

Check Your Credit File for Errors After Your Discharge

Keeping an eye on your credit score after bankruptcy is essential. You want to make sure that there was nothing left on your record that is still affecting your credit negatively. Signing up for a credit monitoring service can help keep your score top of mind. Knowing your credit score can help you decide when you are ready to bu a home or car.

Contact an Experienced Mortgage Consultant

There are several items that can prevent you from qualifying for a government backed home loan. These items include aspects such as credit score, debt-to-income ratio, loan size, location of the property, and your personal income. It is best to speak to an experienced Mortgage Consultant to discuss your options. An experienced Mortgage Consultant can save you time and energy in your journey to a new home, or a better mortgage. Here are some of the ways we can help:

- We offer a detailed and thorough analysis of your credit report. This credit review highlights items that are both positively and negatively affecting your credit score. We also review the report for inaccuracies that are common with our clients that have gone through a bankruptcy

- Our team reviews your goals and try to find options that fit what your goals, instead of treating you like a number.

- Peoples Bank Mortgage has made over a 1,000 loans to clients with a past bankruptcy. We have geared all our products, and efforts to provide the best products and service for you.

Schedule Your FREE Consultation Today

Please call (843) 606-6058 to connect with one of our loan officers. Or Click Here to fill out our FREE consultation request form.

(Published: October 16th, 2018)